Total Years of Service + Highest Three Years of Earnings + Age = Your Pension

Total Years of Service + Highest Three Years of Earnings + Age = Your Pension

SERS calculates your pension on service credit, your highest three years of earnings, and your age. Working longer can mean more money for you due to the additional credit, and potentially, an increase in your earnings.

Don’t Short Yourself on Service Credit

Every bit of service credit helps when calculating your pension. Have you worked in public employment and contributed to another public retirement system? You may be able to combine this with your SERS credit. Did you serve in the military or refund any service credit from an Ohio pension system? Purchasing this credit could increase your pension. Contact us for a cost estimate soon. The earlier you purchase credit, the less it will cost. Check out our Service Credit page to read more information about service credit.

Optimize Your Pension: 30 Years

Optimize Your Pension: 30 Years

30 years of service means 66% of your highest three years of earnings. Each additional year could mean more money and lower health care premiums. Use Account Login to generate multiple estimates to compare.

Choose the Right Plan of Payment

Choose the Right Plan of Payment

Do you have a spouse or beneficiary who will need a portion of your pension in case you die? Plans A, C, D, E, and F can provide for your loved ones after your death. Weigh your options and think about what your spouse or beneficiary will need to survive. If your loved ones are already financially secure, the single life Plan B provides the maximum pension for as long as you live. For more information about Plans of Payment, view the Step Toward Retirement page or download the Plans of Payment handout.

Should You Consider a PLOP?

Should You Consider a PLOP?

A Partial Lump Sum Option Payment (PLOP) provides a portion of your pension up front. A PLOP may make sense for people who want to invest the money themselves, pay off bills, or make a big purchase. It is only available at the time you retire, and reduces your monthly payment for life. The PLOP also is taxable unless you roll it over into a retirement account. The big question is – can you live on the reduced pension?

An Important Health Care Factor: Are You Under or Over 65?

You need 10 years of qualified service credit to be eligible for SERS’ coverage. Are you eligible for Medicare? This is when our health care is most affordable. If you aren’t eligible for Medicare and don’t have at least 20 years, you may find more affordable coverage through the Health Insurance Marketplace. More information about SERS’ coverage is available on the Health Care page.

Tips on Filing Your Application

Tips on Filing Your Application

Be sure to file your application with us 90 days prior to your retirement date. Gather all the required documents listed on our Retirement Checklist. Inform your employer and check into a possible severance package.

What Will You Do When You Retire?

What Will You Do When You Retire?

There are 720 hours in a month. How will you spend your time – golfing, gardening, traveling? Will you be able to afford it? Make a plan, and start budgeting now. Do you want a part-time job? If it is in public employment, ask us about being a reemployed retiree.

When Is the Best Time for YOU to Retire?

When Is the Best Time for YOU to Retire?

Now that you know about your SERS pension, it comes down to this: when is the best time for you to retire? It’s a personal choice. It’s based on your budget, beneficiary, and health care needs. We’re here to provide you with information on the options available.

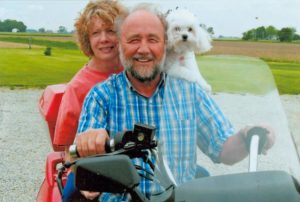

Have Fun!

Enjoy your retirement! Do the things you have always wanted and don’t forget to keep in touch with SERS. Read our newsletters for information about your pension, health care, and overall wellness. Send pictures to us of your life in retirement. We want to share in the fun.