Invest in Yourself

Boost Your Retirement, Start Saving Now

While the definition of “retirement security” is different for everyone, the key to financial freedom in retirement is setting aside extra money during your working years. Saving for retirement is not a luxury, it’s a necessity.

Even if you don’t plan on retiring with a SERS pension, we can be an important part of your retirement plan. All of your employee contributions can be refunded when you leave your SERS-covered position. No matter the amount of the refund, consider rolling that money into a retirement savings account rather than paying high taxes on the refund amount and spending the rest.

As a public employee in Ohio, you have access to one of the best retirement savings options available: Ohio Deferred Compensation. It has many different savings options, and money can be transferred from your paycheck before taxes. The following information illustrates the advantages of saving early for retirement.

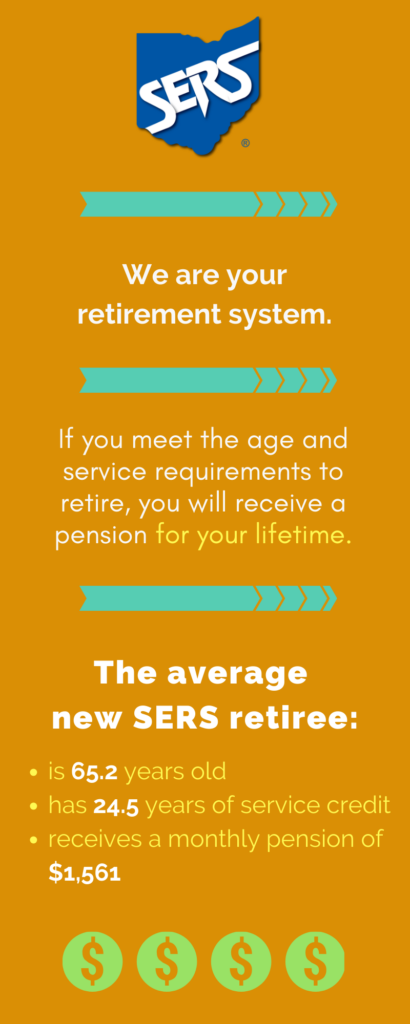

The average new SERS retiree is 65 years old.

They retired with 24.5 years of service credit and receive a monthly pension of $1,561.

Did you know you can run an estimate of your own future monthly pension?

It’s easy to do – simply sign in to Account Login to create your estimate of benefits.

Register for an online account

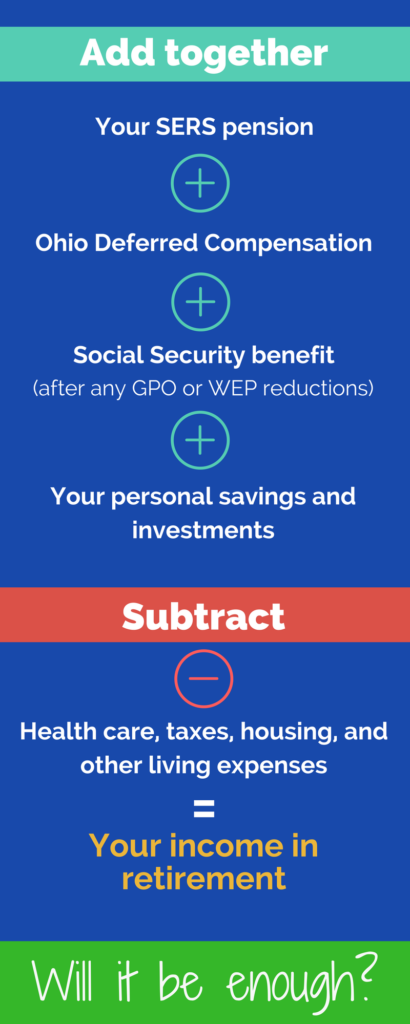

After reviewing your estimate, do you think that amount will be enough to live on in retirement?

Now is the time to assess and adjust your financial plan.