Refunds

Leaving Your SERS Job

After you leave a SERS-covered job, you are entitled to a return of only the contributions you contributed and any amounts you paid for the purchase of service credit.

No Hardship Withdrawals

SERS cannot pay partial refunds of, or provide loans on, a member’s accumulated contributions. A full refund of employee contributions is only available after SERS-covered employment has ended.

Account Options after You Leave Your SERS Job

You are not required to initiate a refund; contributions may be left with SERS. Keeping your account with SERS has several advantages:

- If you return to a SERS-covered job in the future, your account will already be established

- You retain disability benefits you may be eligible for, or benefit protection for your survivors if they are qualified

- If you get a job covered by any of the other Ohio retirement systems, your SERS service credit can be combined for a larger retirement benefit

Here’s an example of the benefits of keeping your account with SERS:

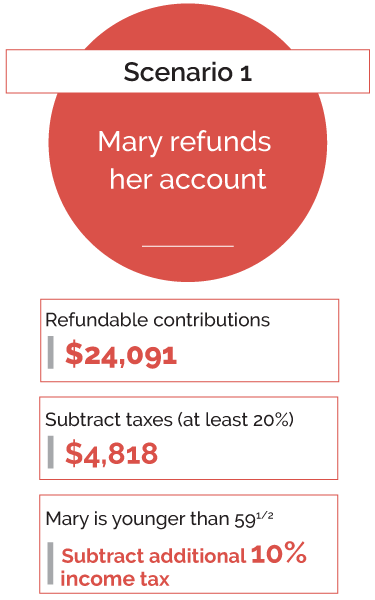

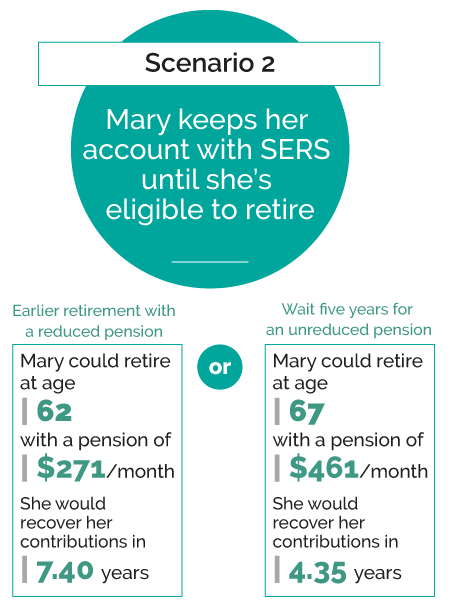

Mary, age 40, is leaving her SERS-covered position as a bus driver after 12 years for a job covered by Social Security. She has the choice of refunding her contributions or leaving her account with SERS. With 12 years of service credit, she will be eligible for a lifetime pension when she reaches age 62 (reduced pension) or age 67 (full pension).

Mary’s contributions: $24,091

Keep in mind, since Mary is under the age of 59 and a half, she would be subject to an additional 10% federal income tax for early distribution if she chooses to refund.

Refund Payment Process

You must complete the Active Member Refund Application for the refund of your accumulated contributions.

If you are also a member of State Teachers Retirement System (STRS) and/or Ohio Public Employees Retirement System (OPERS), you have the option to refund your SERS account without affecting your membership or rights to either a benefit or refund of contributions under those systems. However, due to IRS regulations, you cannot refund your SERS account if you continue employment under either of those systems with the same public employer with whom your last SERS service was earned.

No refund is issued before three months after the termination of employment. If your contributions were made on a pre-tax basis under a “pick-up” plan, the contributions are subject to taxes on payment unless you roll over the contributions to another tax-exempt plan as permitted under federal tax law. You will receive information on these options at the time you apply for a refund.

SERS cannot pay partial refunds of, or provide loans on, your accumulated contributions. No interest is paid on a refund and you receive no part of the employer’s contributions.

Once a refund is paid, you lose any right to a retirement or disability benefit, and your dependents lose any right to survivor benefits.

Finally, if you have the ability to take an age and service retirement, spousal consent is required before a refund is processed.

Taxation

If you choose to refund your SERS contributions, there are tax implications.

If you choose to receive your refund directly from SERS:

- Your refund payment will be taxed in the year in which it is issued.

- SERS is required to withhold federal income tax at a rate of 20%.

- If you are under age 59-1/2, you also may have to pay a 10% tax penalty for an early withdrawal.

If you choose to rollover your refund into an eligible retirement fund such as an IRA, 403(b) plan, or 457(b) plan:

- Your payment will not be taxed in the current year and no taxes will be withheld.

- The rollover funds will be taxed at a future date when you remove them from the account into which they were deposited.

For more information about these and other tax implications concerning a SERS refund, please read the Special Tax Notice Regarding Your SERS Lump Sum Payment.

Divorce

A refund may be subject to any support orders or division of property orders (DOPO) that were issued in divorce proceedings.

Restoring Service Credit after a Refund

After establishing one-and-one-half (1½) years of new service credit with SERS, STRS, OPERS, the Ohio Police and Fire Pension Fund (OP&F) or the Ohio Highway Patrol Retirement System (HPRS), a member may restore SERS credit lost due to a refund by repaying the refunded contributions plus interest.

Refunded service may be restored by one payment or installment payments to SERS. In addition, if offered by the member’s school employer, payments may be made by way of payroll deduction.

Applying for a Refund

If you would like to refund your account, please contact our office toll-free at (800) 878-5853 to request a Refund Application.

Rollover Information for Financial Institutions

The School Employees Retirement System of Ohio (SERS) is a qualified governmental plan under sections 401(a) and 414(d) of the Internal Revenue Code of 1986.

The Internal Revenue Service (IRS) most recently issued a Determination Letter to SERS on May 19, 2017, which was based upon an application SERS filed during the second Cycle E remedial amendment cycle. This Determination Letter does not contain an expiration date. This is consistent with IRS Notice 2016-3’s discussion of Section 21.01(2) of Rev. Proc. 2016-6, which provides that, effective January 4, 2016, determination letters issued to individually designed plans will no longer contain expiration dates.