Service Credit

Service Credit

Service credit is accrued through contributions during school employment and for other service at no cost, or for other service that may be purchased.

The amount of an employee’s service credit determines:

- Eligibility for retirement and disability benefits

- The amount of a benefit

- Eligibility for health care coverage and premium costs

It also determines the eligibility of any dependents for survivor benefits, the amount of benefits, and availability of health care coverage.

Earned Service Credit

An employee receives service credit for the time worked for a school, college, or university. This is called contributing service credit. One year of service credit is granted upon completion of 120 or more days of paid school employment within a fiscal year (July 1 through the following June 30).

There is no distinction between full-time, part-time, or substitute positions in granting this service credit. Any portion of a day constitutes one full day. Paid days that are used, such as sick and vacation, count toward the 120 days.

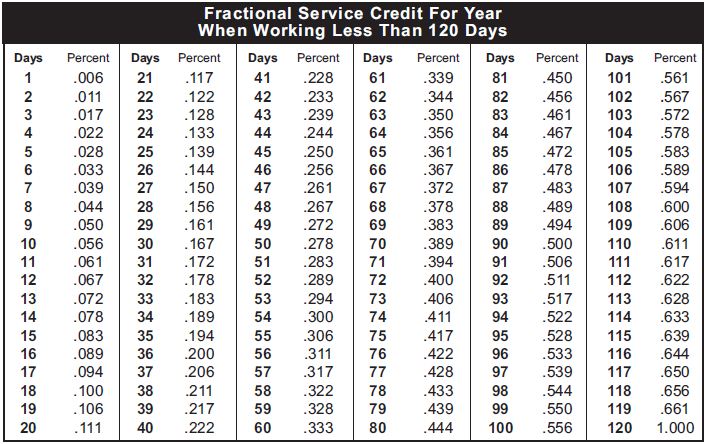

If an employee works less than 120 days, the employee will receive a fractional amount of service credit prorated on the basis of a 180-day school year with the result shown in the following chart:

Early Retirement Incentive (ERI) Plan

An employer may establish an Early Retirement Incentive plan (ERI), which allows certain employees to retire early or increase the service credit of those employees eligible to retire. Employers should contact their own legal counsel for advice on adopting a plan.

The requirements for an ERI plan are found in the Early Retirement Incentive Plan Guide.

An ERI Cost Calculator also is available on eSERS. In this application, employers are able to get an idea of the cost the district will incur if the plan is adopted.

Workers’ Compensation

An employee may receive additional service credit at no cost for periods the employee received Workers’ Compensation.

If the employee was off the payroll due to a school-connected injury and receiving Workers’ Compensation, he or she may receive up to three years of service credit for this time with proof of such compensation.

Employees must provide a Workers’ Compensation awards history report for evaluation of service credit.

Service Credit Purchase (SCP)

Certain types of service credit may be available for purchase by your employee. As the employer, you may be responsible for certifying information and/or making payments to SERS depending upon the type of service credit available to the employee.

If the employee is eligible to purchase service credit, SERS will send a cost letter to the employee for purchasing all or a part of the service credit by making payments directly to SERS in one or more installments, or by payroll deduction, if the employer offers this type of payment plan.

Rollover funds from a qualified plan, such as another employer retirement program (Internal Revenue Code (IRC) 401(a), an Individual Retirement Account (IRA), an IRC 403(a) annuity, an IRC 403(b) plan, or a governmental Deferred Compensation Program under IRC 457 can be used to purchase service credit.

All service credit must be purchased before retirement.

SCP Payroll Deduction

If you offer a payroll deduction plan with amounts designated as picked up contributions, upon request, SERS will send the employee a Payroll Deduction Authorization Form. Once the form is completed by both employee and employer, return it to SERS.

As the employer, you are responsible for transmitting the employee’s payroll deduction to SERS through eSERS using the SCP Payroll Deduction Submission application. Once you have done this, the liability will appear in the Payment Remittance application to pay.

Due to federal tax law, once the employee elects payroll deduction with picked up contributions, he or she cannot increase, decrease, or stop the deductions, unless the employee is terminated or retires.

Any payroll deduction purchase plan that is received on or after January 1, 2019, must be on a post-tax basis. Due to the Internal Revenue Service’s revised position on such programs, SERS will no longer accept pre-taxed, picked-up payroll deductions for the purchase of service credit.

To recap:

- Payroll deductions initiated before January 1, 2019 are pre-tax

- Payroll deductions initiated after January 1, 2019 must be on a post-tax basis

Refunded Service Credit

If an employee had previous SERS service credit and received a refund of contributions for this service after terminating employment, the employee may restore all or part of the service credit.

After establishing one-and-one half (1.5) years of new service credit with SERS, State Teachers Retirement System (STRS), or Ohio Public Employees Retirement System (OPERS), the Ohio Police and Fire Pension Fund (OP&F) or the Ohio Highway Patrol Retirement System (HPRS), the employee can restore SERS credit cancelled due to a refund by repaying the refunded contributions plus interest.

Refunded service may be restored by one payment or installment payment to SERS.

If offered by school district, payment may be made through a payroll deduction plan. An employee also may purchase refunded service from the other State Pension Plans.

Leave of Absence

If your employee was on a school board-approved unpaid Leave of Absence (LOA) for educational or professional purposes, illness, or disability, the employee may purchase the LOA credit for this time by paying both the employee and employer contributions, plus interest.

A LOA period begins on the first day of the approved leave for which contributions were not made, and ends with the approved leave ends or when the employee returns to contributing service, whichever happens first. The employer must certify the earnings the employee would have received during the LOA, so that SERS can calculate the cost to the employee. This information is submitted on a Certification of Salary for Non-Contributing Service form.

Service credit may be purchased for multiple leaves of absence. The total years purchased cannot exceed five years, and the maximum amount of service that may be purchased for a period of leave is two years.

Non-contributing Service with a SERS-covered Employer

Exempt

For any service on or after July 1, 1991, an employee may purchase credit for service in a position for which SERS’ membership was compulsory, but the employee was permitted to, and did, sign an exemption from membership form. The cost for each year of service credit is 20% of the employee’s current year of compensation.

Under certain circumstances, employees may be eligible to purchase STRS or OPERS exempted service with SERS. If SERS prepares the cost estimate, the cost for each year is 20% of the employees most recent years of SERS compensation.

The employee cannot purchase this credit if the compensation for such service was subject to taxes under the Federal Insurance Contributions Act (FICA).

Optional

For any service before July 1, 1991, an employee may purchase credit for service in a position for which SERS’ membership was optional, and the employee did not choose to enroll in SERS’ membership. The cost for each year of service credit is an amount equal to the employee contributions in effect at the time, plus interest, and the employer contributions in effect at the time, plus interest.

As the employer, you must certify the earnings the employee received during this period so that SERS can calculate the cost to the employee. This information also is submitted on a Certification of Salary for Non-Contributing Service form.

Compulsory

Pre-1991: If an employee was employed by a school for a period before July 1, 1991, and membership was required, but contributions were not paid, the employer for that service is required to pay the employer contributions in effect at the time, plus interest.

The employee must pay the employee contributions in effect at the time, plus interest.

Post-1991: If an employee was employed by a school for a period on or after July 1, 1991, and membership was compulsory (required), but contributions were not paid, the employer for that service is responsible to pay both the employee and employer contributions in effect at the time, plus interest. The employer must certify the earnings the employee received during this period so that SERS can calculate the cost.

This information also is submitted on a Certification of Salary for Non-Contributing Service form. After SERS receives this information and calculates the cost, a cost statement is sent to the employee, and/or the employer, depending on when the service was performed. Currently, the interest is at 7.5%.

Other Government or School Service

An employee may purchase credit for service with:

- A public or private school, college, or university in this state or another state, or operated by the federal government, which has been chartered or accredited by the proper government agency

- The federal government, or non-Ohio government employers, if the service in a comparable position in Ohio would have been covered by SERS, STRS, OPERS, OP&F, or HPRS

- A public employer for which contributions were made to an Ohio municipal retirement system except the Cincinnati Retirement System

The maximum amount of service credit that may be purchased is the lesser of five years, or the total years of the employee’s Ohio service credit.

If the employee combines SERS service credit with STRS and/or OPERS service credit at retirement, the total amount of other government or school service credit is limited to five years among all the systems.

The service credit is not available if it is or will be used in another retirement benefit except for Social Security. For each year of credit, the employee must pay contributions based on the first year of full-time SERS-covered employment following termination of the service to be purchased plus interest from the date of SERS’ membership to the date of payment.

Resignation Due to Pregnancy or Adoption of a Child

If an employee was required to resign because of pregnancy or adoption of a child, the employee may purchase service credit for this time.

The employee must have returned to work by the beginning of the third school year after the resignation and earned a year of contributing service credit after the returning.

No more than a total of two years of service credit can be purchased. For each year of credit, the employee must pay contributions based on the first year of full-time SERS-covered employment after returning to work, plus interest from the date of the return to work to the date of payment.

The employer at the time of the resignation is responsible for paying the employer contributions and interest.

Military Service

There are several ways in which an employee may obtain military service credit depending on when the employee entered the service and returned to public employment. These include:

Free

If an employee was a SERS member for at least one year, left school employment for active duty in the armed forces, and returned to public service covered by SERS, STRS, or OPERS within two years of an honorable discharge and established one year of service credit, up to 10 years of free military service credit may be granted.

This service cannot be added if it is or will be used in any other retirement program except Social Security.

There is no cost for this service.

Interrupted

If an employee is not eligible to receive free credit for military service that interrupted school employment, the employee may purchase up to five years of military service credit, but only if he or she:

- Worked for a SERS-covered employer and was a SERS member

- Entered the Military while still employed

- Returned to work with the same employer within three months of an honorable discharge or release from military service

- Maintained SERS’ membership

The employee’s employer must certify the earnings the employee would have received during the period of military service so SERS can calculate the cost. This information is submitted on a Certification of Salary for Non-Contributing Service form.

The cost is an amount equal to the employer and employee contributions in effect at the time if the employee had remained on the school’s payroll. The employer is responsible for the employer contributions.

Other Military Service

If the employee is not eligible to receive military service credit either free or for purchased as described above, the employee can still purchase military service. Up to five years of active duty in the armed forces, and up to an additional five years for time spent as a prisoner of war may be purchased.

If the employee combines SERS service credit with any STRS and/or OPERS service credit the employee has at retirement, the total amount of service credit is limited to five years among all the systems.

The employee must send SERS a copy of a discharge (DD214), or separation notice.

This service cannot be purchased if it has been or will be used in any other retirement program except Social Security or retired pay for non-regular service under 10 U.S.C. 12731-12739, or if the member contributed to SERS during the same period of time.

School Board Member Service

A school board member is a member of a city, local, exempted village, or joint vocational school district board of education, and a governing board member is a member of an educational service center governing board.

A SERS member who was a school board member or governing board member before July 1, 1991, the employee may be eligible to purchase .250 of a year for each year of board service with their retiring system.

The member must pay the actual liability for this service credit. It can be purchased no sooner than 90 days before retirement.

If this service was at the same time as other SERS service credit, it cannot be purchased.

Other Retirement Systems

An employee of more than one Ohio retirement system, including OPERS or STRS, may retire separately from each of the systems, if eligible. The employee may also combine the contributions, earnings, and service credit for a greater pension or disability benefit.

The system with the greatest service credit will be the system that will calculate and pay the benefit.

While the salaries in one year will be added together, if the service credit in each system is for the same year, the employee cannot be credited with more than one year of service credit for each 12 months in a year.

Cincinnati Retirement System

If an employee refunded contributions from the Cincinnati Retirement System (CRS), the employee can purchase that time. If the contributions are still on deposit, they may be transferred to SERS prior to retirement.

Ohio Police & Fire Pension Fund or Ohio Highway Patrol Retirement System

If an employee refunded contributions from OP&F or HPRS, the employee can purchase that time. If the contributions are still on deposit, they may be transferred to SERS prior to retirement.