Investment Highlights

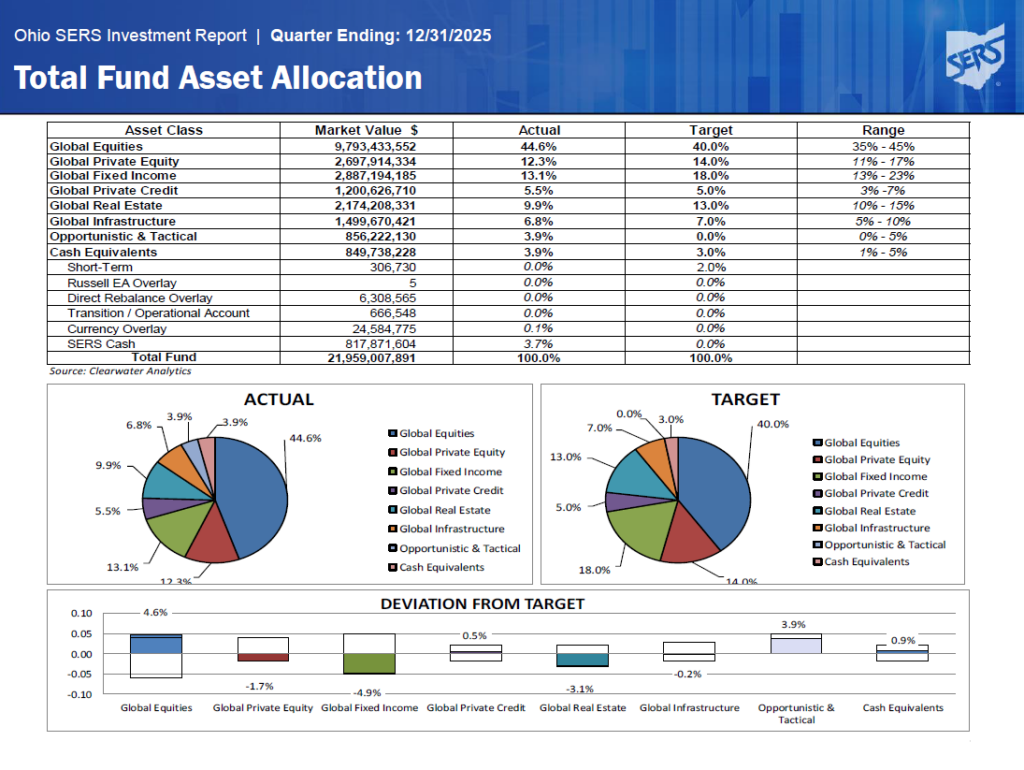

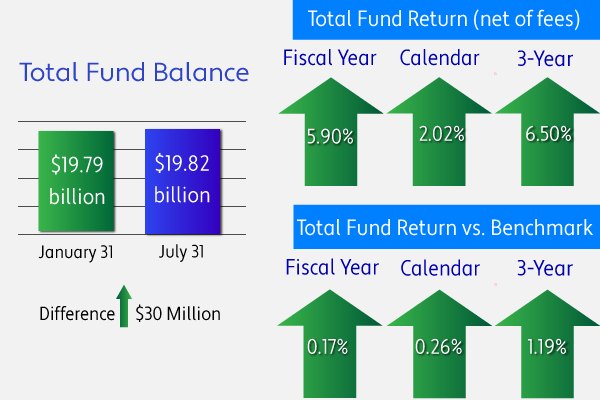

For fiscal year ending June 30, 2025, SERS’ investment net return was 11.17% with $20.63 billion in assets. The Fund outperformed the policy benchmark by 1.05%. SERS maintains a diversified investment portfolio including global equities, global bonds, global private credit, global real assets, global private equity, and short-term securities.

Monthly Investment Report

February 2026 Total Fund Update

SERS Investments – 101

Global Equities – Equities are investments in company stock. Equi ty investments usually increase or decrease in price depending on the company’s financial performance. SERS’ global equity allocation is split equally between US and non-

ty investments usually increase or decrease in price depending on the company’s financial performance. SERS’ global equity allocation is split equally between US and non-

US investments.

Global Private Equity – Private equity investments are usually direct investments in private companies that are reorganizing or growing, or situations where one company is buying another. Private equity investments often require long holding periods to allow for a turnaround of a distressed company or the sale of a company to another buyer.

Global Fixed Income – SERS’ global fixed income portfolio consists of core assets (Treasuries, corporate bonds, and mortgages), core plus assets (below investment grade corporate bonds, non-US debt, and emerging market debt), and emerging market debt assets (bonds issued by less developed countries).

Global Real Assets – SERS’ global real assets portfolio is made up of a majority of real estate investments and some infrastructure investments. Real estate is divided into core strategies (properties that produce income through rents) and non-core strategies (those that appreciate in value over time).

Global Private Credit – Broadly defined as strategies that provide loans and financing to middle market companies in lieu of bank financing. Strategies can have objectives of either preserving capital, with return coming primarily from current pay coupon and fees or maximizing appreciation of more subordinated loans. The most common types of private credit strategies include direct lending, mezzanine, structured credit, and distressed debt.

Opportunistic and Tactical – This asset class allows SERS to invest in short-term, nontraditional opportunities (such as direct lending) that do not fit within any of the other asset classes.

Investment Links

Quarterly Investment Performance

On a quarterly basis, SERS posts reporting to our website that provides total fund and asset class net of fee time-weighted returns along with details of the alternative investments within the SERS investment portfolio. It is important to note these reports are net of all fees.

Quarterly Investments Performance Report for Quarter Ending:

|

|

December 31, 2024 |

Ohio-Qualified Managers & Brokerage Firms

These certification forms with instructions and qualification criteria, as well the Ohio-Qualified Managers and Broker/Agent list can be accessed below.

Ohio-Qualified Manager Certification

Ohio-Qualified Agent Certification

Ohio-Qualified Broker/Agent List

Doing Business with Retirement Systems in Ohio: Ethics Commission Information Sheet

Corporate Governance

SERS Investments Recognition

“SERS’ due diligence is robust and consistent across asset classes. SERS’ investment officers are professional, know the managers as well or better than their peers, and focus on relevant issues and risks.”

“SERS’ risk management efforts are at or above prevailing practices for its peer group.”

“The Statement of Investment Policy (SIP) is at leading practice levels. It specifies delegations and responsibilities, includes a statement of investment beliefs, defines the major risks and risk management approaches, as well as including the asset allocation, implementation approach, and performance benchmarks. It is detailed, yet clear and concise.”

“(SERS’) due diligence practices to hire managers are at or above prevailing practice levels; the operational due diligence practices are at leading practice levels.”

“Controls within Investment Accounting are well designed and functioning. The tone of accountability set by SERS’ Executive Management, coupled with its policies regarding training, staffing, the control environment, control activities, communications and monitoring is effective.”

SERS’ historical Total Fund gross-of-fees returns ranked in the top 10% nationally when compared with more than 380 U.S. pension funds over the 1-, 3-, 5-, and 10-year periods. Over one year (0.19%) and three years (9.76%), SERS ranked 4th; over five years (9.29%), SERS ranked 3rd; and over 10 years (9.78%), SERS ranked 2nd.

Thank You, but No Gifts, Please

Employees and Board members of SERS are governed by provisions of the Ohio Ethics Law. Those provisions limit anyone from offering, and us from accepting, gifts, including food, beverages and travel-related expenses. To abide with the ethics laws, we request that you not send gifts to, or make donations to charity on behalf of, SERS and any SERS Board or staff members. Click here to learn more from the Ohio Ethics Commission regarding the ethics laws governing the Ohio Retirement Systems.

Thank you for your attention and cooperation in this matter.