FINANCIAL INVESTMENT

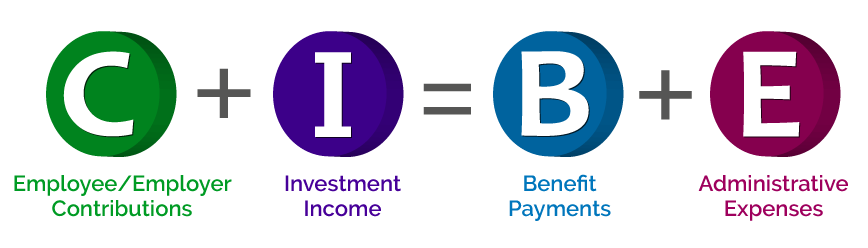

SERS is a defined benefit public pension plan. This means that SERS’ primary responsibility is to assure that sufficient funds will be available to provide lifetime retirement and disability benefits, as well as survivor benefits, Medicare B, and lump sum death benefits. Laws governing SERS’ financing intend that contributions rates remain approximately level from generation to generation. SERS works with an actuary to calculate the future cost of benefits being earned today and what amount of employer contributions must be set aside to cover those benefits.