Member Enrollment

Member Enrollment

Using eSERS

Employees and reemployed retirees can only be enrolled electronically through eSERS, SERS’ secure site designated just for employers. eSERS provides you with an effective, time-saving way to submit employee information online.

Enroll new employees and reemployed retirees by using the “Upload Enrollment Files” or “Manual Enrollment Entry” applications found on eSERS.

All new employees must be enrolled in SERS and complete a federal form, SSA-1945.

As the employer, you are responsible for the timely and accurate submission of enrollment information. The individual’s account is established only when the documentation is accepted by SERS.

You will not be able to submit contribution reporting for the individual until an enrollment is uploaded or manually entered into eSERS.

If you are not registered with eSERS, contact the Employer Web Administrator (EWA) for your school district. Your EWA is able to grant you access to eSERS.

If you have further questions, call us at 1-877-213-0861 or email us at employerservices@ohsers.org.

Checking an Enrollment

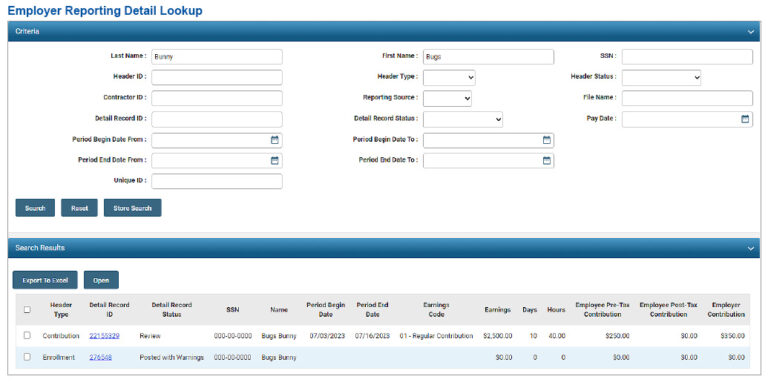

If you are unsure as to whether an employee has been enrolled in SERS, go to the “Employer Reporting Detail Lookup” application on eSERS, and search by the employee’s Social Security number or first and last name.

If the employee has already been entered, the enrollment will appear in the “Search Results” panel.

If the employee’s enrollment information does not populate, double check the Social Security number. If that is correct, then enroll the new employee.

The above example is an employee search by first and last name. The employer is able to see that the Social Security numbers are transposed, and a correction needs to be made.

When you notice that a member enrollment has been entered into eSERS incorrectly, please do not enter a new enrollment, contact Employer Services for assistance.

SSA-1945 Form

Federal regulations require employers to submit a Statement Concerning Your Employment in a Job Not Covered by Social Security Form (SSA-1945). The form explains how public employment may affect Social Security benefits.

You must submit a copy to SERS once it has been signed by the employee.

The SSA-1945 Form can be uploaded into eSERS using the “SSA-1945 Upload” application (PDF’s only). It also can be faxed to SERS at 614-340-1195, or mailed to SERS at 300 E. Broad St., Suite 100, Employer Services, Columbus, Ohio, 43215.

Due to security reasons, please do not email the form to Employer Services.